CapEx Finance Index (CFI) May 2025: Demand Rose; Financial Conditions Remained Healthy

-

FORECAST: New business volumes suggest a 0.7% increase in new durable goods orders in May.

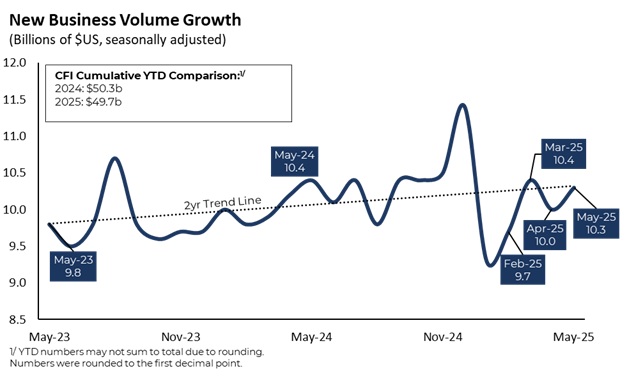

- Total new business volume (NBV) rose by $10.3 billion seasonally adjusted among surveyed ELFA member companies, an increase of 3.0% from the prior month.

- NBV year-to-date contracted by 1.2% relative to the same period in 2024.

- Year-over-year, NBV dropped by 3.7% on a non-seasonally adjusted basis.

WASHINGTON, June 25, 2025 (GLOBE NEWSWIRE) -- “The May CFI survey confirmed that the equipment finance industry had a good start to 2025. Demand for new equipment picked up in the latest data, particularly at captive businesses, and industry-wide financial conditions remained healthy,” said Leigh Lytle, President and CEO at ELFA. “The May delinquency data was largely unchanged after accounting for an outlier, and losses were stable, both good signs considering the restrictive stance of monetary policy. The slow bite of tariffs may still emerge this summer, and conflict abroad could impact energy prices and supply chains, but the string of solid CFI surveys is yet another clear indication that the equipment finance industry is going to be tough to slow down in 2025.”

New business volumes picked up. New business volumes rose by 3.0% in May from the previous month to $10.3 billion. The increase was nearly exactly in line with the recent two-year trend. New business volumes for small ticket deals were up 17.8%, the fifth consecutive month of double-digit volatility. It was also a nearly complete reversal from the 18.3% decline in the prior month. New volumes grew by 14% at captives and 5.0% at independents from April to May but declined by 3.0% at banks. That contrasts with the recent increase in bank volumes relative to captives and independents. The six-month rolling average of activity at banks as a share of total new volume activity jumped by 7.3 percentage points over the last year. That gain has come at the expense of new deals at captives, where the share of new activity has dropped by a nearly identical 7.3 percentage points.

Employment levels were lower than at the same time last year. The 12-month change in total employment was down 1.2% from May 2024. That’s an eight-tenths improvement from the 2.0% decline that was recorded in April. Employment was up at banks and independents and down at captives.

Credit approvals remained elevated. The overall credit approval rate edged down by four-tenths of a percentage point to 77%. The May rate is the second highest reading in the last two years; the highest was last month at 77.4%. The average approval rate on small ticket items declined by half of a percentage point but also remained near its two-year high.

Financial conditions were largely unchanged. Industry-wide delinquencies rose by more than percentage point, from 1.8% to 2.9%, from April to May. Adjusting for an outlier showed a more modest rise in 30-day aging receivables of around a tenth of a percentage point to 1.9%. Delinquencies for small ticket deals and at independent companies were also impacted. The loss rate was essentially unchanged from April.

“New business activity has been strong for our equipment finance business this year and up significantly from the first five months of 2024 as economic fundamentals that we favor—labor market strength, moderating inflation, easing monetary policy, strong corporate earnings—remain resilient,” said David Drury, Senior Vice President and Head of Commercial Specialty Lending, Fifth Third Bank, National Association. “However, we suspect these fundamentals will deteriorate until a clear path forward for global trade is agreed upon by policymakers and businesses alike, and may present headwinds for equipment financing activity in the second half of the year.”

Industry Confidence

The Monthly Confidence Index from ELFA’s affiliate, the Equipment Leasing & Finance Foundation, increased to 58.2 in June, rebounding from tariff pressures after dramatic lows in April and May.

About ELFA’s CFI

The CapEx Finance Index (CFI) is the only real-time dataset that tracks nationwide conditions in the equipment financing industry. The information is compiled from a diversified set of businesses that respond to questions about demand for equipment financing, employment, and changes in financial conditions. The resulting data is organized by institution type, such as banks, captives, and independents, and is classified into overall activity and financing for small ticket equipment and software. The CFI is released monthly from Washington, D.C., generally one day before the U.S. Department of Commerce's durable goods report. More detail on the data and methodology can be found at www.elfaonline.org/CFI.

About ELFA

The Equipment Leasing & Finance Association (ELFA) represents financial services companies and manufacturers in the $1 trillion U.S. equipment finance sector. ELFA’s over 600 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at www.elfaonline.org.

Follow ELFA:

X: @ELFAonline

LinkedIn: https://www.linkedin.com/company/115191

Media/Press Contact: Jane Esworthy, Vice President, Communications & Marketing, ELFA, jesworthy@elfaonline.org

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f5541bc2-8141-4f5e-a659-55cac4443beb

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.