Pain Management Drugs Market Size Worth USD 125.68 Billion by 2034 Driven by Aging Population and Rising Chronic Pain Cases

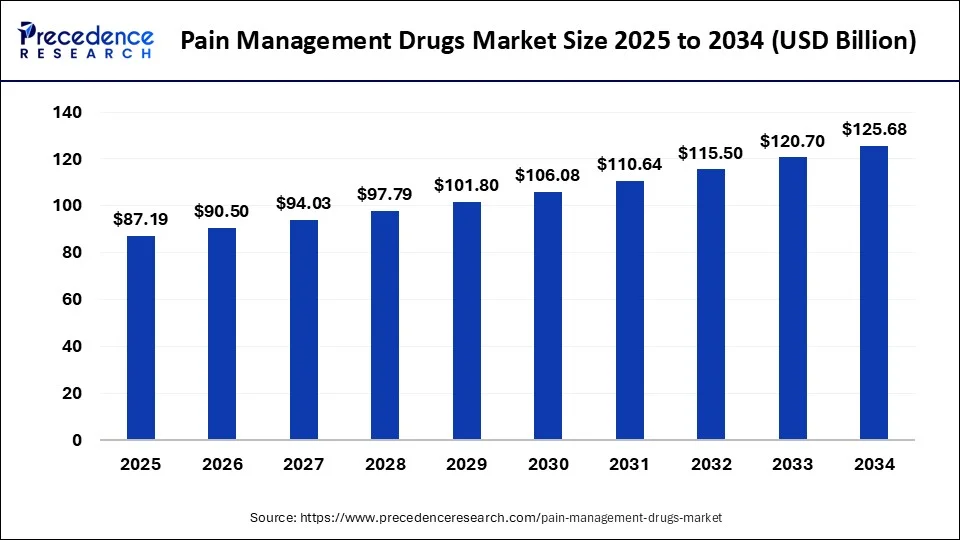

According to Precedence Research, the global pain management drugs market size will grow from USD 87.19 billion in 2025 to nearly USD 125.68 billion by 2034, with a CAGR of 4.10 % from 2025 to 2034. The market is set for steady growth, fueled by rising demand for non-opioid alternatives, innovations in drug delivery systems, and increasing cases of chronic pain. Favorable regulations and strong R&D investments are shaping the future of pain relief therapies worldwide.

Ottawa, Sept. 25, 2025 (GLOBE NEWSWIRE) -- The global pain management drugs market is expected to be worth more than USD 125.68 billion by 2034, growing from USD 87.19 billion in 2025. The market is expected to expand at a strong compound annual growth rate (CAGR) of 4.10% from 2025 to 2034. North America leads the global market. Technological innovations in drug delivery, a suitable regulatory scenario, a rise in the senior population, and rising demand for non-opioid analgesics are driving the growth of the market.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2494

Pain Management Drugs Market Takeaways

- In terms of revenue, the global pain management drugs market was valued at USD 84,080 million in 2024.

- It is projected to exceed USD 125,680 million by 2034.

- The market is growing at a CAGR of 4.10% from 2025 to 2034.

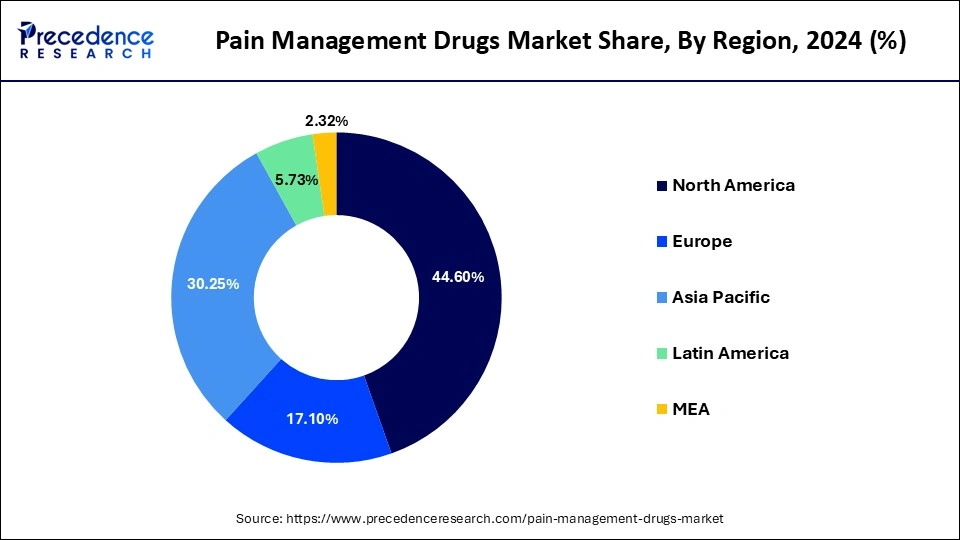

- North America dominated the pain management drugs market with the largest market share of 44.60% in 2024.

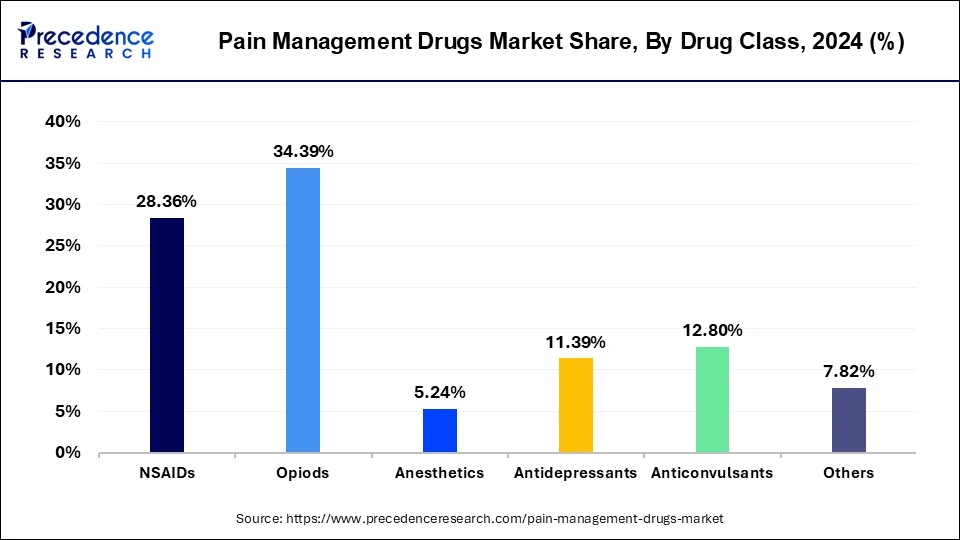

- By drug class, the Opiods segment captured the highest market share of 34.39% in 2024.

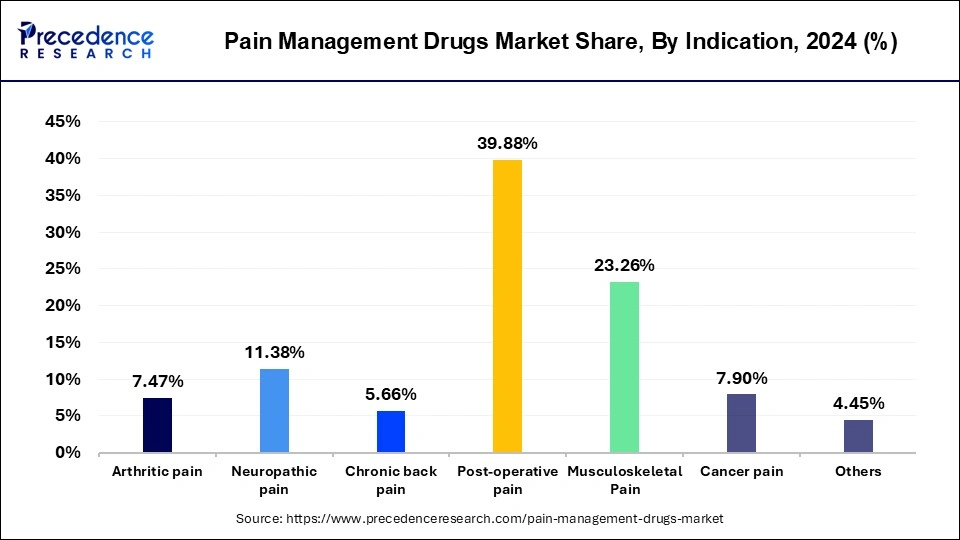

- By indication, the post-operative pain segment contributed the highest market share of 39.88% in 2024.

- By distribution channel, the retail pharmacies segment generated the major market share of 35.36% in 2024.

Pain Management Drugs Market Size, by Drug Class, 2022-2024 (USD Million)

| Drug Class | 2022 | 2023 | 2024 |

| NSAIDs | 22,013.2 | 22,905.2 | 23,845.4 |

| Opioids | 27,275.7 | 28,067.5 | 28,917.5 |

| Anesthetics | 4,073.2 | 4,232.7 | 4,408.9 |

| Antidepressants | 8,561.5 | 9,053.9 | 9,573.0 |

| Anticonvulsants | 10,183.5 | 10,461.5 | 10,759.6 |

| Others | 6,302.9 | 6,433.5 | 6,571.4 |

Pain Management Drugs Market Size, by Indication, 2022-2024 (USD Million)

| Indication | 2022 | 2023 | 2024 |

| Arthiritic pain | 5,708.5 | 5,986.6 | 6,283.0 |

| Neuropathic pain | 8,962.3 | 9,252.9 | 9,564.1 |

| Chronic back pain | 4,298.2 | 4,520.4 | 4,759.1 |

| Post-operative pain | 31,591.5 | 32,535.3 | 33,531.7 |

| Musculoskeletal Pain | 17,928.8 | 18,718.5 | 19,556.2 |

| Cancer Pain | 6,275.0 | 6,454.1 | 6,644.3 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2494

What are the Pain Management Drugs?

Pain management drugs are defined broadly as any medication that relieves pain. Many different pain medicines exist, and each one has benefits and disadvantages. Specific pain responds to some drugs than others. Many people with chronic pain have a better quality of life with a pain management program and feel better physically and mentally. Studies show that current chronic pain treatment can result in about a 30% decrease in pain scores.

Painkillers, also known as analgesics, are medications that relieve different types of pain, from headaches to injuries to arthritis. Anti-inflammatory analgesics reduce inflammation, and opioid analgesics change the way the brain perceives pain. Pain management drugs are medicines that reduce or relieve headaches, sore muscles, arthritis, or other aches or pains. Anti-inflammatory drugs work by reducing inflammation at the site of the pain.

Latest Private Industry Investments for Pain Management Drugs

- Nivaan Care raised about US$4.25 million in a seed round to scale its network of chronic pain management clinics and incorporate regenerative medicine treatments.

- NeuroMed Technologies secured US$32 million in a Series C round led by MPM Capital to advance its pipeline of chronic pain drugs targeting calcium channels.

- Latigo Biotherapeutics obtained US$150 million in Series B financing to develop non-opioid pain therapeutics by targeting the NaV1.8 sodium channels.

- Clearing raised over US$20 million in seed funding to build out a technology platform offering individualized nonaddictive pain treatment plans delivered directly to patients.

- SiteOne Therapeutics received US$100 million investment from Novo Holdings and others to support proof-of-concept development of new non-opioid pain treatments.

Pain Management Drugs Market Key Trends

- Shift Toward Non-Opioid Pain Relief: The ongoing opioid crisis has accelerated demand for non-opioid alternatives like NSAIDs, antidepressants, and anticonvulsants. Regulatory pressure and public health concerns are pushing both R&D and prescribing practices toward safer options.

- Rising Demand for Chronic Pain Treatments: With aging populations and increasing cases of arthritis, cancer, and diabetes, chronic pain management is a growing priority. Drug makers are focusing on long-duration formulations that provide consistent relief without frequent dosing.

- Advancements in Drug Delivery Systems: Innovations such as transdermal patches, extended-release pills, and intranasal sprays are improving how pain medications are administered. These technologies enhance patient compliance and minimize side effects.

- Growth of Cannabinoid-Based Therapies: Medical cannabis and synthetic cannabinoids are gaining traction as legal frameworks evolve. They offer promising alternatives for managing chronic and neuropathic pain with fewer risks of addiction.

-

Personalized and Targeted Pain Therapies: Precision medicine is enabling treatments tailored to individual genetic and biological profiles. This approach is especially valuable in neuropathic pain, where response to drugs varies widely among patients.

➤ Get the Full Report @ https://www.precedenceresearch.com/pain-management-drugs-market

Pain Management Drugs Market Opportunity

Advancements in Drug Delivery Systems

Advancements in drug delivery systems will be an opportunity for the market. Recent drug delivery systems (DDS) are formulated with improved properties like sustained delivery, toxicity, stability, specific site targeting, efficacy, increased solubility, increased permeability, automation, enhanced performance, precision, and smaller particle size. Targeted drug delivery can result in improved pharmacokinetics, like increased absorption, distribution, metabolism, and excretion (ADME). This may lead to more predictable drug levels and reduced variability in response to treatment.

Pain Management Drugs Market Challenges

Side Effects and Safety Concerns

Side effects and safety concerns can be limitations of the pain management drugs market. Some pain management drugs can cause side effects. Pain management drugs' side effects include slowed breathing, clouded thinking, drowsiness, sedation, nausea, dry mouth, vomiting, and constipation. NSAID painkillers like diclofenac and ibuprofen may cause serious side effects like bleeding in the stomach and stomach ulcers. This risk can be reduced considerably by taking medicine to protect the lining of the stomach.

Pain Management Drugs Market Report Coverage

| Report Attributes | Statistics | |

| Market Size in 2024 | USD 84.08 Billion | |

| Market Size in 2025 | USD 87.19 Billion | |

| Market Size in 2031 | USD 110.64 Billion | |

| Market Size by 2034 | USD 125.68 Billion | |

| CAGR 2025 to 2034 | 4.10% | |

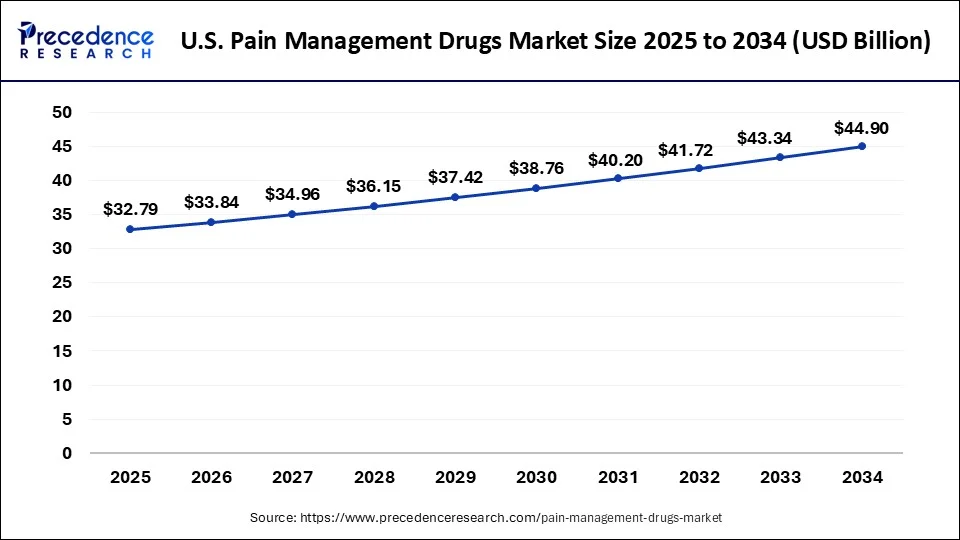

| U.S. Market Size in 2025 | USD 32.79 Billion | |

| U.S. Market Size by 2034 | USD 44.90 Billion | |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia Pacific | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | Drug Class, Indication, Distribution Channel, and Region | |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa | |

| Key Players | Teva Pharmaceutical, Pfizer, Abbott, Mallinckrodt Pharmaceuticals, Endo International, GlaxoSmithKline, AstraZeneca, Depomed, Merck, Novartis, and others. | |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

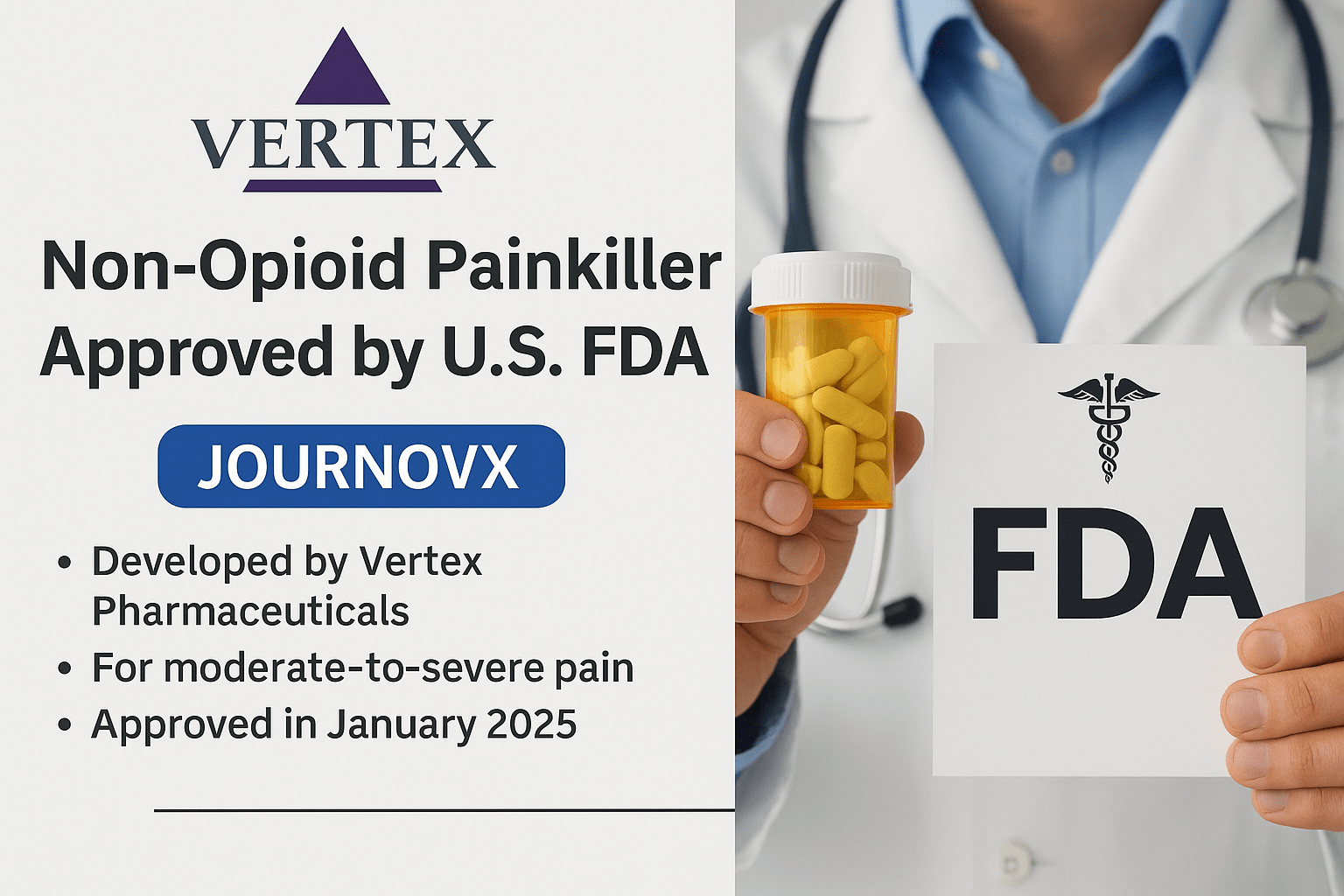

Case Study — Vertex Pharmaceuticals’ Non-Opioid Breakthrough Gains FDA Approval

Amid growing regulatory and public health pressure to curb opioid use, Vertex Pharmaceuticals pursued the development of a non-opioid oral painkiller (Journovx) to provide effective pain relief without the risk of addiction.

Challenge

The global pain management drugs market is highly competitive, dominated by traditional opioids and NSAIDs. To secure a position, Vertex had to demonstrate both efficacy and safety while addressing unmet demand for opioid-free alternatives.

Strategy

- Designed large-scale late-stage clinical trials comparing Journovx against standard opioid therapies.

- Partnered with regulatory bodies under fast-track FDA approval pathways, leveraging the U.S. push for safer pain treatments.

- Positioned Journovx as a treatment for moderate to severe pain linked to surgery, trauma, and medical procedures, targeting a high-demand use case.

Outcome

- In January 2025, Journovx was approved by the FDA as a non-opioid alternative for moderate-to-severe pain management.

- The approval was widely recognized as a milestone in shifting the market away from addictive opioids.

- Analysts expect this launch to reshape prescribing practices, open new non-opioid drug classes, and create fresh growth avenues in a market projected to reach USD 125.68 billion by 2034.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Pain Management Drugs Market Regional Landscape:

- North America pain management drugs market size surpassed USD 37.50 billion in 2024 and it is expected to grow at a CAGR of 3.70% from 2025 to 2034.

- Europe pain management drugs market size was estimated at USD 14.37 billion in 2024 and is growing at a CAGR of 3.8% from 2025 to 2034.

- Asia Pacific pain management drugs market size accounted for USD 25.43 billion in 2024 and it is anticipated to grow at a CAGR of 4.9% from 2025 to 2034.

How big U.S. Pain Management Drugs Market?

The U.S. pain management drugs market size was evaluated at USD 31.80 billion in 2024 and is projected to surpass around USD 44.90 billion by 2034, growing at a CAGR of 3.60% from 2025 to 2034.

How North America Dominated the Pain Management Drugs Market?

North America dominated the global market in 2024 because of the rising senior population, rising demand for non-opioid analgesics, rising number of surgical procedures, and increasing incidences of chronic pain in the region. North America has experienced rapid growth in the prevalence of chronic pain, driven by an aging population and demand for surgical procedures. The ongoing research initiatives for novel drug delivery systems and the development of non-opioid alternatives are contributing to this growth. Regulatory support and approvals for novel drug developments and technological advancements emphasize this growth.

The U.S. dominates the regional market due to its large population suffering from chronic pain, advanced healthcare infrastructure, and strong pharmaceutical industry presence. High rates of conditions like arthritis, cancer, and post-surgical pain drive consistent demand, while leading drug manufacturers and extensive R&D investments fuel innovation in both opioid and non-opioid therapies. Additionally, favorable regulatory pathways, such as fast-track FDA approvals, and widespread insurance coverage support rapid adoption of new treatments.

- In February 2024, the launch of COMBOGESIC IV (acetaminophen and ibuprofen) injection in the US was announced by Hikma Pharmaceuticals PLC (Hikma), a multinational pharmaceutical company. COMBOGESIC IV is an opioid free, intravenous pain relief medicine that is a combination of 300 mg of ibuprofen and 1000 mg of acetaminophen, a non-steroidal anti-inflammatory drug (NSAID). The company offers health care providers a new multi-model approach to adult pain management. ( Source: https://www.prnewswire.com)

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/2494

Asia Pacific Pain Management Drugs Market

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period due to the advancement in pharmaceutical research and development, increasing senior population, and increasing global prevalence of chronic diseases in the Asia Pacific region. The growth in surgical procedures and post-pandemic demands has increased in countries like China, India, and Japan. The increased demand for non-opioid alternatives and a strong focus on advancing personalized medicines are fostering this growth. Additionally, the market is experiencing spectacular growth with increased demand for over-the-counter (OTC) pain relievers.

- In September 2024, Nimulid Strong, a gel and spray formulation to address neck pain, a condition that impacts overall body function, was introduced by Mankind Pharma’s consumer business division. Along with this, Mankind Pharma entered the topical analgesic market. (Source: https://www.healthcareradius.in)

China dominates the regional market due to its large aging population, rapidly expanding healthcare infrastructure, and growing burden of chronic diseases like arthritis, cancer, and diabetes. Government initiatives to improve pain care, along with increased healthcare spending and access to insurance, have boosted demand for both traditional and modern pain therapies. Additionally, China has a strong domestic pharmaceutical industry that manufactures both generic and branded pain medications at scale, enhancing affordability and availability.

Pain Management Drugs Market Segmentation Insights

Drug Class Insights

Which Drug Class Segment Dominated the Pain Management Drugs Market in 2024?

The NSAIDs segment held a dominant presence in the market in 2024, as NSAIDs are a class of medications used to treat pain, fever, and other inflammatory processes. NSAIDs, or non-steroidal anti-inflammatory drugs, are medications that can relieve pain and reduce fever and inflammation. Nonsteroidal anti-inflammatory drugs ease the pain and inflammation. NSAID benefits also include reducing fever, decreasing stiffness, easing pain, and reducing inflammation.

- In May 2022, the launch of Ketorolac Tromethamine Tablets USP, 10 mg, a therapeutic generic equivalent of the reference listed drug Toradol Tablets, 10 mg, in the U.S. market, approved by the U.S. Food and Drug Administration, was announced by Dr. Reddy’s Laboratories Ltd and Senores Pharmaceuticals. Ketorolac Thromethamine Tablets, USP, 10 mg, are an NSAID indicated for the short-term management of moderately severe acute pain that needs analgesia at the opioid level, and only as continuation treatment following intramuscular or intravenous dosing of Ketorolac tromethamine, if required. (source: https://www.businesswire.com)

The opioids segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Opioids are generally used for the treatment of pain, and include medicines like morphine, tramadol, and fentanyl. Their misuse, prolonged use, non-medical use, and use without medical supervision can lead to opioid dependence and other health problems. Long-acting opioids relieve moderate to severe pain. They are also known as extended-release opioids.

Indication Insights

What Made Neuropathic Indication Lead the Pain Management Drugs Market?

The neuropathic segment led the market in 2024, due to the benefits of pain management in neuropathy include balance exercises, strength exercises, flexibility training, aerobic exercises, improve posture, improve range of motion, reduce fall risks, improve balance, increase muscle strength, increase blood flow and circulation, support the recovery of damaged nerves, ease pain, and help to improve mental, physical, and emotional well-being.

- In September 2025, a new treatment for peripheral neuropathy was available in DuBois, Pennsylvania, according to Mercy Family Health. Restorative Healthcare offers StemWave shockwave therapy, a drug-free, non-invasive option for managing symptoms and chronic pain associated with the condition. ( Source: https://markets.businessinsider.com/)

The cancer pain segment is projected to grow fastest in the market between 2025 and 2034. Most cancer pain is manageable, and controlling our pain is an essential part of our treatment. Cancer pain is a common symptom of cancer and a side effect of cancer treatment. Cancer pain may be moderate, mild, or severe and take many forms. Pain management for cancer includes spinal cord stimulation, intrathecal drug delivery, neurolytic procedures, steroid injections, scrambler therapy, muscle relaxers, and anti-inflammatory drugs.

Distribution Channel Insights

Which Distribution Channel Leads the Pain Management Drugs Market?

The retail pharmacies segment led the market, as the retail pharmacies play an important role in healthcare by providing convenient access to medications, a wide range of products, and valuable additional services. Additional prescription medications offered by retail pharmacies include surgical supplies, over-the-counter remedies, and health supplements. They may offer a wide selection of medications and supplementary health products, addressing diverse healthcare needs. Retail pharmacies streamline the medication access process.

The online pharmacy segment is set to grow fastest in the market from 2025 to 2034. By providing a convenient avenue for accessing medications, online pharmacies contribute to enhancing healthcare outcomes and reducing disparities in access to essential treatments. Research indicates that digital tools in pharmacy practices have resulted in more individualized and efficient patient care. Online pharmacies offer many benefits, including improved accessibility, reduced travel time, and cost.

- In May 2025, an online platform that allows consumers to compare the prices of branded drugs with their bioequivalent generics was launched by the Retail pharmacy chain Medkart Pharmacy. The newly launched online platform provides transparent information on alternatives, drug prices, and compositions. ( Source: https://pharma.economictimes.indiatimes.com)

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

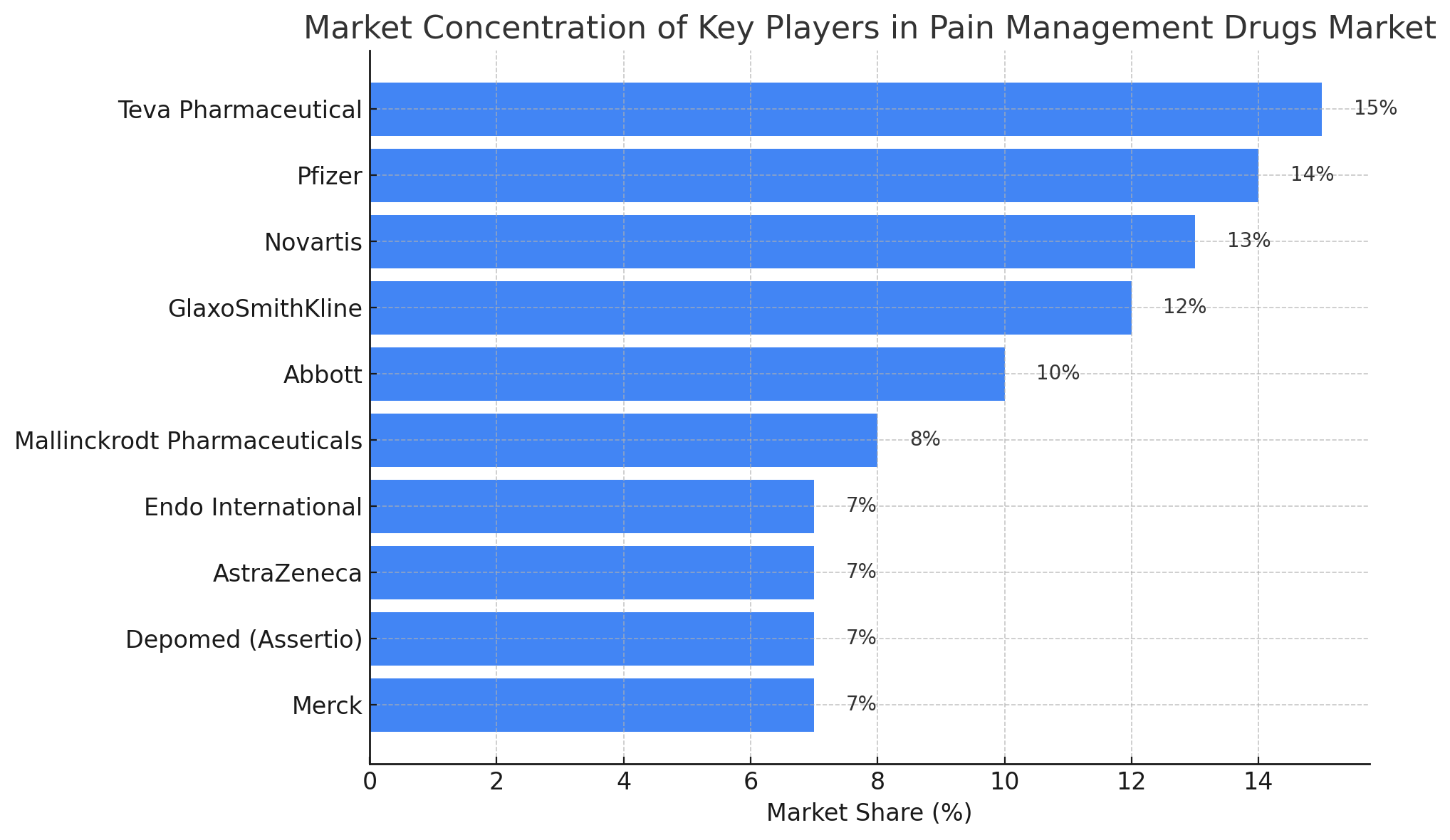

Pain Management Drugs Market Concentration and Competitive Landscape

The global pain management drugs market is a moderately concentrated but highly competitive industry, where multinational corporations with diversified drug portfolios dominate, and mid-sized firms and specialized biopharma players compete through niche expertise and pipeline innovation. Market concentration is influenced by a combination of scale advantages, regulatory scrutiny, litigation risks, and the pace of non-opioid innovation.

Market Concentration

- Top-tier dominance: The top five companies (Teva, Pfizer, Novartis, GSK, Abbott) account for a large portion of global sales, primarily due to extensive generic portfolios, established OTC pain relief brands, and strong penetration in chronic pain and post-operative care markets.

- Moderate consolidation: While no single company controls an outsized market share, the sector shows moderate concentration (Herfindahl–Hirschman Index estimated in the 1,500–2,000 range), indicating a mix of dominant incumbents and meaningful competition from smaller firms.

-

Regulatory and litigation barriers: Opioid-related lawsuits have weakened the competitive positions of Mallinckrodt and Endo, reshaping the industry’s concentration in favor of diversified players like Pfizer and Novartis, and creating openings for emerging biotech entrants developing non-opioid therapies.

Source: Precedence Research

Key Players and Strategic Positions

-

Teva Pharmaceutical

- Global leader in generic opioids and NSAIDs.

- Market edge from cost competitiveness, scale in distribution, and branded generics.

- Actively diversifying toward non-opioid analgesics to reduce opioid dependency.

-

Pfizer

- Anchored by Lyrica (pregabalin) in neuropathic pain and fibromyalgia.

- Leverages strong R&D engine in neuropathic and targeted therapies.

- Long-term strategy includes precision medicine approaches in pain management.

-

Abbott

- Strong in branded generics and musculoskeletal pain drugs, especially in emerging markets.

- Focus on OTC channels and supportive health solutions, which boost consumer trust and accessibility.

-

Mallinckrodt Pharmaceuticals

- Specialist in extended-release opioid formulations.

- Facing reputational and legal risks due to opioid litigations, limiting growth.

- Positioned as a hospital-focused supplier rather than consumer-driven.

-

Endo International

- Heavy reliance on opioid brands (Percocet, Opana ER).

- Weakening due to legal exposure, limited diversification, and restructuring needs.

- May face M&A pressure or consolidation by larger peers.

-

GlaxoSmithKline (GSK)

- Global OTC powerhouse with Panadol as a flagship brand.

- Leads in consumer health and non-prescription pain relief, giving it resilience in volatile prescription markets.

-

AstraZeneca

- Pipeline focus on neuropathic and inflammatory pain therapies.

- Relies more on early-stage R&D collaborations and less on established pain products.

-

Depomed (Assertio Therapeutics)

- Known for extended-release chronic pain drugs (Nucynta ER).

- Smaller but specialized, competing through drug delivery technology innovations.

-

Merck

- Historical presence with Vioxx; now invested in non-opioid R&D with a focus on anti-inflammatory innovation.

- Potential to re-enter pain management leadership through safer alternatives.

-

Novartis

- Stronghold in NSAIDs (Voltaren) with both prescription and OTC formulations.

- Leveraging global consumer health distribution to strengthen dominance in non-opioid pain relief.

Analyst View for Investors and B2B Stakeholders:

- Shift in concentration dynamics: Market power is moving away from opioid-centric companies toward diversified pharma giants and biotech innovators.

- Non-opioid innovation: Companies with pipelines in cannabinoids, sodium channel blockers (NaV1.8), and targeted drug delivery systems are positioned for outsized growth.

- M&A opportunities: Smaller firms with breakthrough pipelines (e.g., SiteOne Therapeutics, Latigo Biotherapeutics) are prime acquisition targets for Pfizer, Novartis, or AstraZeneca to accelerate non-opioid strategies.

- Investor implication: A moderately concentrated market with high barriers to entry but shifting leadership. Investors should monitor regulatory approvals, litigation exposure, and late-stage pipeline developments as the key value drivers.

Top Companies Landscape:

-

Teva Pharmaceuticals - Manufactures a wide range of generic pain medications, including opioids like oxycodone and tramadol.

-

Pfizer - Offers Lyrica (pregabalin), a key treatment for neuropathic pain and fibromyalgia.

-

Abbott - Provides branded generics for musculoskeletal pain, along with supportive diagnostic and nutritional solutions.

-

Mallinckrodt Pharmaceuticals - Specializes in opioid-based pain management drugs, including extended-release formulations.

-

Endo International - Markets prescription opioids such as Percocet and Opana ER for moderate to severe pain.

-

GlaxoSmithKline (GSK) - Offers over-the-counter pain relief products like Panadol, a widely used paracetamol-based analgesic.

-

AstraZeneca - Provides treatments like Nexium for gastrointestinal pain and conducts research in neuropathic pain therapies.

-

Depomed (now Assertio Therapeutics) - Develops extended-release pain medications such as Nucynta ER for chronic and neuropathic pain.

-

Merck - Previously marketed Vioxx and continues to research non-opioid treatments for pain and inflammation.

- Novartis - Markets Voltaren (diclofenac), a leading NSAID used for treating inflammation and musculoskeletal pain.

Recent Developments:

- In January 2025, Vertex Pharmaceuticals, a non-opioid painkiller pill, a new alternative for pain relief that comes without the risk of addiction, was approved by the Food and Drug Administration. Vertex’s drug, Journovx, is generally approved for the treatment of moderate to severe pain, which is generally caused by trauma, illness, surgery, injury, or painful medical procedures, and likely eases with time. (Source: https://www.cnbc.com)

- In October 2023, to launch the non-opioid treatment in the United States by early next year, the U.S. health regulator has approved Hyloris Pharmaceuticals’ drug for post-operative pain, a Belgium-based company. The US FDA (Food and Drug Administration) decision was based on data from a late-stage study, which showed the drug to be more efficient in relieving pain than the generally used intravenous paracetamol. (Source: https://www.reuters.com)

Pain Management Drugs Market Segmentation

By Drug Class

- NSAIDs

- Opioids

- Anesthetics

- Antidepressants

- Anticonvulsants

- Others

By Indication

- Arthritic Pain

- Neuropathic Pain

- Chronic Back Pain

- Post-Operative Pain

- Cancer Pain

- Others

By Distribution Channel

- Online Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2494

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Oxycodone Drugs Market: Explore how oxycodone-based therapies are addressing moderate to severe pain management worldwide.

➡️ Cold Pain Therapy Market: Discover how cold therapy solutions are reducing pain, inflammation, and recovery times in sports and post-surgery care.

➡️ Non-Opioid Pain Patches Market: Learn how non-opioid transdermal patches are offering safer, effective alternatives for chronic pain relief.

➡️ Pain Management Devices Market: See how advanced devices are transforming chronic pain treatment with non-invasive and minimally invasive technologies.

➡️ Osteoarthritis Therapeutics Market: Understand how innovative drugs and biologics are improving quality of life for osteoarthritis patients.

➡️ Pain Management Therapeutics Market: Explore how evolving pharmacological treatments are reshaping strategies for chronic and acute pain care.

➡️ Non-Opioid Pain Treatment Market: Discover how non-opioid therapies are revolutionizing pain management while minimizing addiction risks.

➡️ Nefopam Hydrochloride Injection Market: Learn how nefopam hydrochloride injections are providing effective non-opioid solutions for moderate pain relief.

➡️ Muscle Relaxant Drugs Market: See how muscle relaxants are addressing musculoskeletal pain, spasms, and neurological conditions globally.

➡️ Pain Relief Oil Market: Explore how natural and herbal pain relief oils are gaining traction as safe, accessible solutions for everyday pain management.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.